|

Tariffs play a significant role in shaping global trade and, by extension, the cost structures of businesses that rely on imported goods. These duties, imposed by governments on imported products, can significantly affect pricing strategies, supply chain decisions, and overall cost management. To better understand how industry professionals handle tariffs in their cost models, SPCEA recently conducted a LinkedIn survey to determine how tariffs are treated within cost models.

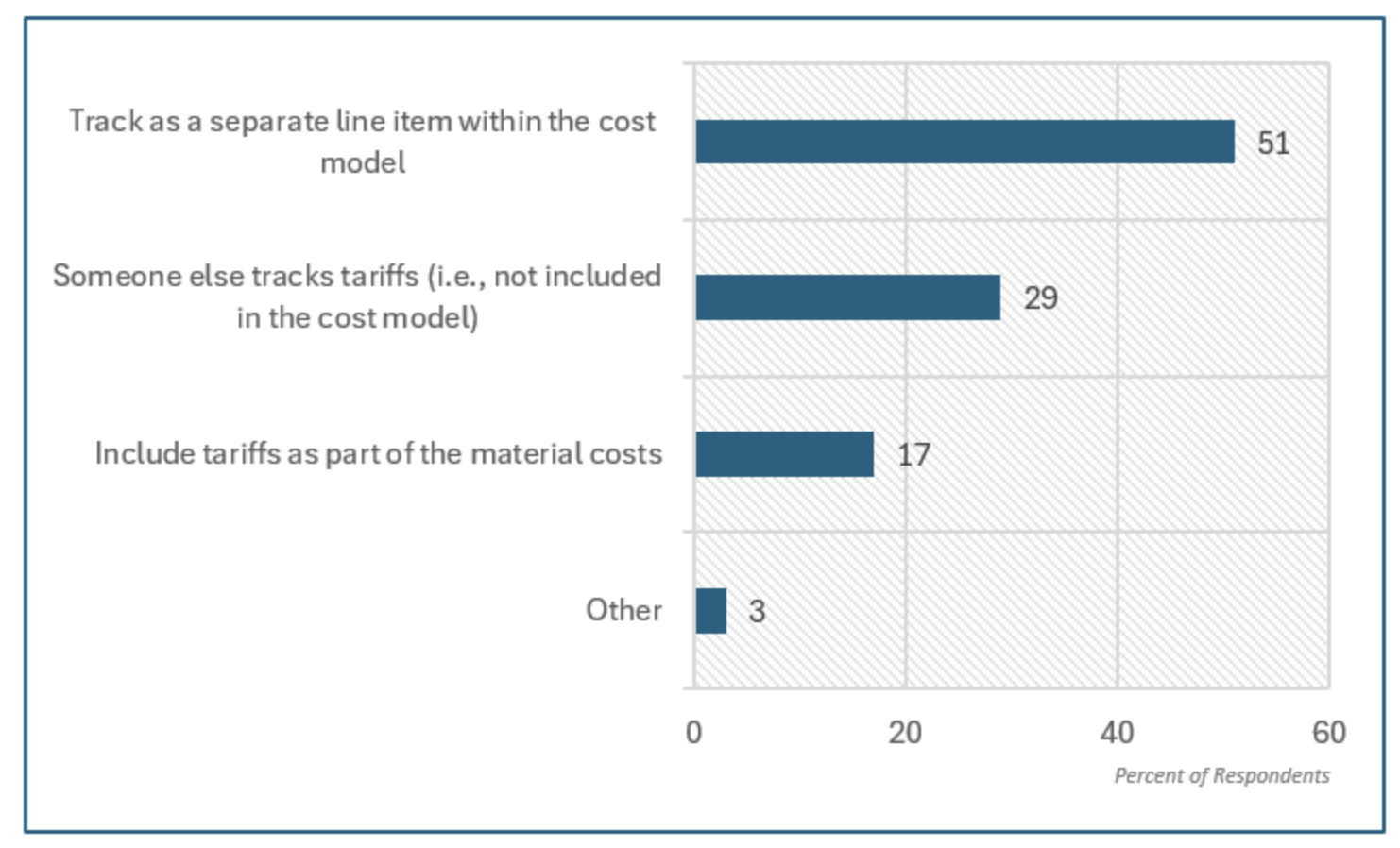

A total of 35 responses were received, with the following distribution (shown in percent of respondents):

Breaking Down the Responses:

- “Track As a Separate Line Item Within The Cost Model”

Most respondents (51%) prefer to track tariffs as a separate line item within the cost model. This approach allows for greater transparency in cost analysis, making it easier to assess the direct impact of tariffs on overall expenditures. By isolating tariffs, businesses can adjust pricing strategies dynamically and ensure accurate reporting.

- “Someone Else Tracks the Tariffs (i.e. Not Included in The Cost Model)”

29% of the respondents indicated that someone else tracks tariffs, meaning these costs are not directly incorporated into their cost models. This approach could be common in organizations where tariff management falls under the purview of finance or logistics teams rather than cost engineering departments. While this method can streamline certain cost-modeling processes, it may obscure the direct financial impact of tariffs on specific products or materials.

- “Include Tariffs as Part of The Material Costs”

Another 17% of respondents include tariffs as part of the material costs. This integration simplifies the cost model by bundling tariffs with material expenses, but it can also make it challenging to pinpoint tariff-driven cost fluctuations separately from other supply chain variables.

- “Other”

Finally, 3% selected ‘Other,’ indicating alternative methods of handling tariffs within their financial structures. It is not clear if these responses may reflect unique industry practices, customized cost models, or evolving strategies to address tariff-related expenses.

The Broader Implications

Understanding how tariffs are incorporated into cost models is essential for businesses aiming to optimize their pricing and sourcing strategies. Organizations that track tariffs separately benefit from enhanced visibility and better strategic decision-making, while those embedding tariffs within material costs may prioritize simplicity over granular insight. As global trade policies continue to evolve, businesses must remain agile, ensuring their cost models accurately reflect these external financial pressures.

By staying informed and adapting to best practices, companies can mitigate tariff-related risks and

maintain competitive pricing structures in an increasingly complex global marketplace.

|