Don’t Ignore the Investment

During my four decades as a consultant, it has never ceased to amaze me how little attention manufacturing firms pay to the amount of time they use the equipment they’ve invested in to generate a return on that investment. The equipment uptime needed to drive their cost models is seldom available and must be somehow be estimated. Although they see their equipment as an available and valuable resource, they don’t appear to treat it as an investment. They fail to grasp to economic impact of idle equipment and how that relates to their return on investment (ROI).

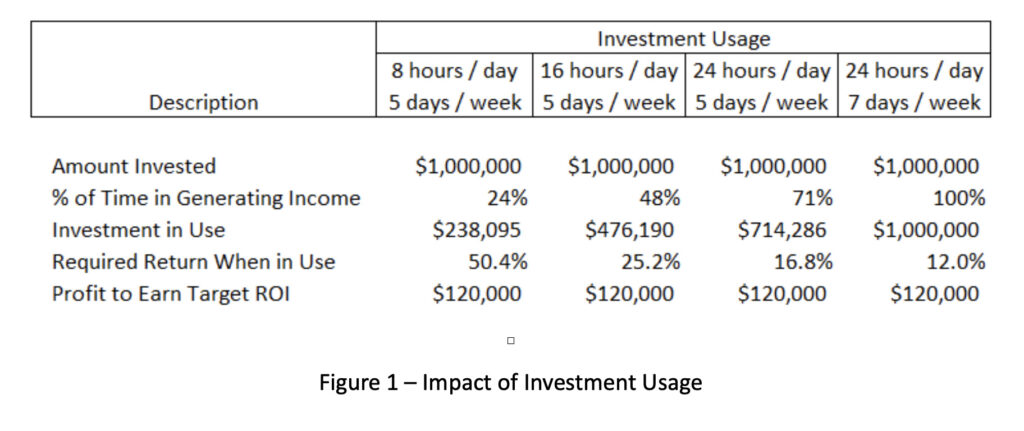

Let’s look at a simple, straight-forward situation where an individual invests $1 million with the expectation of earning a 12%, or $120 thousand, annual return on that investment. It is assumed that the $1 million will be at work full-time, 24/7/365 earning that $120 thousand. If it is at work full-time, it only needs to be earning at the rate of 12%.

But what if that investment is only at work eight hours a day, five days a week? It will be idle approximately 76% of the time, during which it will generate a 0% ROI. As shown Figure 1, it will need to earn at the rate of 50.4% while it is at work if it is to earn $120 thousand for the year. If it works sixteen hours per day, five days per week it will need to earn at the rate of 25.2% and if it is at work twenty-four hours per day, seven days per week it will need to earn at the rate of 16.8%. Only if it as work full-time, twenty-four hours, seven days per week will it meet the expected return of $120 thousand while earning at the rate of 12%.

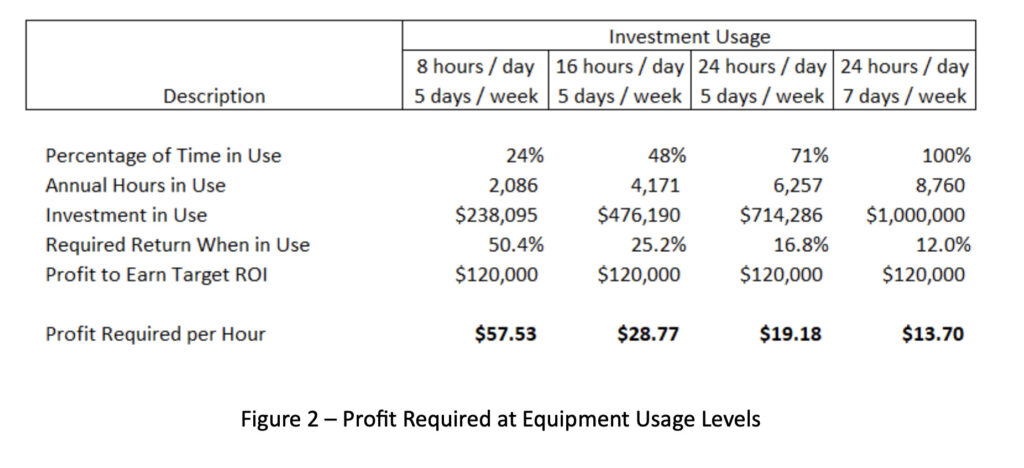

Let’s translate this to a manufacturing setting. An entrepreneur starts a small manufacturing business by investing $1 million in new equipment. His hope is to earn a 12% return on that investment. As shown in Figure 2, if he only uses that equipment eight hours per day, five days per week, he’ll need to earn a profit of $57.53 for every hour it is in use if he is to earn his 12% ROI. That $57.53 has nothing to do with its relationship to sales dollars; instead, it relates to the use of the investment. Similarly, using the equipment sixteen hours per day, five days per week will require a $28.77 profit every hour it is in use and using the equipment twenty-four hours per day, five days per will require a $19.18 hourly profit.

It doesn’t matter if these amounts are 50%, 20%, 10% or 2% of sales, as long as the company averages the required profit per hour of operation it will achieve its targeted ROI. So why do so many manufacturing (and other) organizations use profit as a percentage of sales to measure the value a product, service, or customer is to the organization when it has little to do with its ultimate financial objective of maximizing ROI? My guess is that no one ever pointed out to them the inconsistencies between the measure with the objective. Or perhaps, they just don’t care to challenge a fundamental part of a long-held belief system. After all, rocking the boat a bit might be dangerous and jeopardize one’s employment, might it not?

One way to measure how a product’s, service’s, or customer’s ROI stacks up against the organization’s targeted ROI is to incorporate a weighted average cost of capital (WACC) as one of the organization’s operating costs. The process is fairly simple. Determine the organization’s WACC (which includes the organization’s targeted ROI) and the investment value of the assets in each or the organization’s activity centers. Then apply the WACC to each activity’s asset value to arrive at the annual ROI expected of those assets. Those amounts are then treated as fixed annual costs, handled in the traditional way companies handle depreciation expense. When incorporated into the organization’s rates for costing products, services, and customers, the “cost” represents the revenue required by each product, service, or customer to meet the organization’s ROI target. Granted, determining the organization’s WACC or asset investment values (and assigning them to activities) can’t always be described as simple, but it is an important step in ensuring the revenues generated by the organization are also generating its targeted ROI.

In an era where advanced technology, analytical concepts, and sophisticated software are at the forefront of management accountants’ interest and attention, isn’t it critical for us to apply them to fundamentally valid economic principles? To steal an analogy from Henry Ford; Why use technology to make a faster horse when you can use it to create an automobile?

Read Doug’s next article, Expenses vs. Investments.

Written by Doug Hicks

Author, speaker, educator and President of D. T. Hicks & Co., a consulting organization concentrating on the managerial costing needs of small and mid-sized organizations. A graduate of the University of Michigan – Dearborn’s School of Management and a member of the Michigan Association of CPAs, the Institute of Management Accountants, and the Executive Board of the Society of Cost Management.